Intelligent, flexible, proven.

Voyatek RevHub is the leading enterprise platform for tax that meets the most pressing needs of state revenue agencies.

Enhance agency protection with fraud detection, event investigation, and insider threat alerts

Deliver a better self-service experience for reduced wait times, higher self-cure rates, and increased compliance

Understand, prepare for, and easily adapt to legislative changes

Why RevHub?

RevHub has a flexible, scalable architecture and can be deployed as a complete Integrated Tax System (ITS) or a point solution with integration with existing ITS solutions. This “right size” approach means that RevHub can fit within any budget and deliver a quick ROI.

Improves the taxpayer experience, stops fraud, increases compliance, and decreases the tax gap through

the use of advanced analytics and ML/AI

Adapts to policy changes and easily integrates with existing solutions or replaces legacy systems

Delivers results at the state and local level through a modern tech stack and streamlined user interface

Plus, RevHub has a flexible, scalable architecture for deployments as a complete Integrated Tax System (ITS), or a point solution with integration with existing ITS solutions. This “right size” approach means that RevHub can fit within any budget and deliver a quick ROI.

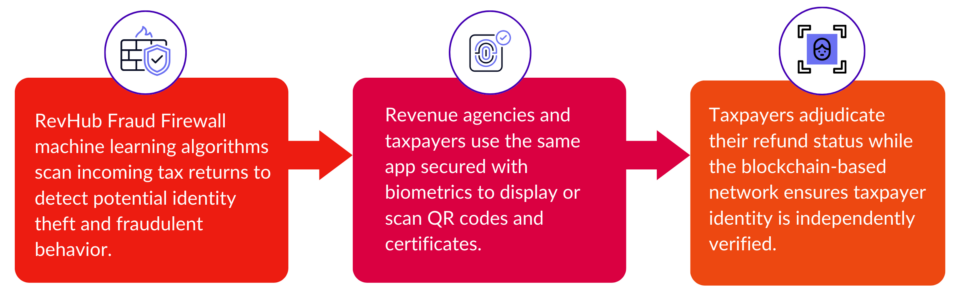

The Decentralized Identity Difference with RevHub

Exclusive to RevHub is Voyatek’s Decentralized Identity for Government (DIG), which detects and prevents fraudulent refunds, allows taxpayers to manage their digital identity information, and gives state and local governments the ability to authenticate resident identity without putting their security or privacy at risk. With Voyatek DIG, taxpayers can validate and manage their refund status through an easy-to-use digital identity solution. Our solution allows residents to have complete control over their identities and personal data, while enabling government agencies to access the information they need to provide services. Our exclusive DIG solution is:

Decentralized Identity for Government and RevHub – How it Works

RevHub with Decentralized Identity is the comprehensive SaaS solution state and local governments rely on to increase privacy and decrease fraud for its constituents.

RevHub – Tackling More Than Fraud

While fraud detection is a major component of RevHub, its rapid results modules target the most pressing issues in tax administration through pre-built analytic solutions.

With Audit Optimizer, states can identify and prioritize quality cases for audit while minimizing manual screening and scoping processes.

RevHub Collections Accelerator formulates analytic collection recommendations to identify the likelihood an account will pay, and the best workstream for each account.

With the Tax Policy Simulator, states can maximize efficiency and plan for the future by analyzing the impact of key variables in various tax scenarios.

Learn more