A Comprehensive Solution for Remote Sales Tax Compliance

Voyatek’s Remote Seller Solution helps states bring remote sellers into compliance using AI-based lead generation, behavioral analytics, and advanced case management.

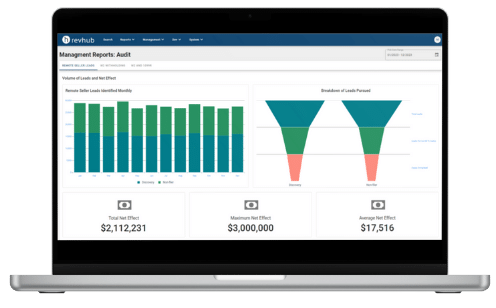

State revenue agencies using RevHub Remote Seller have collected an additional $18M since 2020.

More than $1 of every $5 spent on retail in 2022 came from online purchases. As long as ecommerce sales are on the rise, so is the amount of potential tax revenue generated by remote sellers. While most states have adopted laws that apply to such businesses, actually collecting the revenue can be challenging. Voyatek’s Remote Seller eliminates these obstacles.

Challenges

Lack of preexisting knowledge, processes, data, etc. when implementing a new program

Limited data available to identify firms that may have nexus

No third-party information reporting to confirm accuracy of returns

Limited resources to devote to new work

Our Solution

Intuitive, AI-powered user experience built on industry expertise & proven success

Data on over 6M websites with AI capabilities to predict nexus

Tailored algorithms to detect noncompliance among existing filers

Automated, data-driven notice campaigns to promote voluntary compliance