Maximize Remote Seller Revenue with Data and Analytics

Maximize Remote Seller Revenue with Data and Analytics

Collecting the appropriate taxes from remote sellers— , i.e., businesses that sell into a state but don’t have a physical presence there. —could increase states’ revenue by millions of dollars each year. The Government Accountability Office estimated that if remote sellers were brought into compliance, states could collectively gain upwards of $30B annually. States have employed a variety of strategies to address remote seller noncompliance, including wide-reaching informational campaigns to encourage remote sellers to register appropriately or using “Top 1000” lists to identify and contact online retailers, but these barely scratch the surface. Most programs leave millions on the table because they’re hindered by a few recurring challenges:

- The sheer scale of the marketplace: There are millions of remote sellers operating today. While it would be impossible to bring them all into compliance, states need a way to prioritize remote sellers that will yield the highest ROI.

- Limited resources: Finding remote sellers is labor-intensive and often involves a highly manual search and discovery process.

- Complexity of compliance: There are a variety of noncompliance types, each which requires a specific approach [graphic below]. Plus, parent-subsidiary relationships make it difficult to know which entity should be filing or which businesses are complying.

These challenges aren’t insurmountable, though. States can exponentially improve their efforts to bring remote sellers into compliance by leveraging advanced data and analytics.

A Better Approach

It all starts with the data.

First, states need reliable data to identify the compliant population of businesses. From there, they can seek out the missing—or noncompliant—entities. But manual searches and purchased databases aren’t enough. Voyatek’s solution leverages the latest open-source tools to scrape the web for millions of online retailers and marketplace facilitators. We also scrape the web for parent/subsidiary relationships, which allows us to understand corporate structures and better target the parties responsible for tax filings.

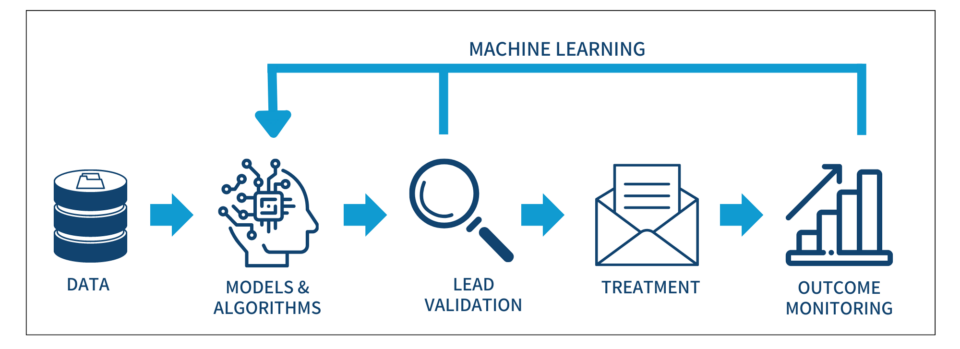

From there we use predictive models and algorithms that (1) identify online retailers that do not appear to be filing with the state and (2) estimate the likelihood that those entities actually have nexus within the state. This allows us to be strategic about which remote sellers we prioritize.

Now that we have a target list of remote sellers that is accurate and actionable, we again turn to the data to help us develop the best treatments. For example, instead of sending out an identical letter to thousands of businesses, we use behavioral analytics to make data-driven decisions about the language used, the intervals of communication, and more.

Finally, we continuously monitor and measure the outcomes of the treatments. Are we successfully converting these leads into compliant taxpayers? How are our efforts translating into added tax revenue? By capturing this data, we create a powerful feedback loop.

Over time, the models become more accurate in determining nexus and home in on the types of non-compliance present in your state. This means that we’re increasingly targeting businesses in your state’s “sweet spot.” These entities are smaller than the e-commerce giants (that are likely already compliant) but larger than the mom-and-pop shops that don’t meet the filing threshold—enough revenue to be worth chasing. And once businesses are brought into compliance, they are very likely to remain compliant for the next 5, 10 years and beyond resulting in meaningful revenue that states can leverage to better serve their constituents.

In fact, our solution has helped states capture upwards of $18M in additional revenue since 2020.

Click here to learn more about our Remote Seller solution or contact us to set up a demo.

-Voyatek Leadership Team